“The real reasons behind Nigeria’s economic recession”

August 28th, 2017 Oluwasegun Olakoyenikan, 22, a Correspondent from Benin City, Nigeria, explains how the lack of sound economic policy is a major reason for the country’s current recession.

Oluwasegun Olakoyenikan, 22, a Correspondent from Benin City, Nigeria, explains how the lack of sound economic policy is a major reason for the country’s current recession.

One year after the official announcement of Nigeria’s recession by the National Bureau of Statistics (NBS) in its quarterly Gross Domestic Product (GDP) report, several discussions have continued to ensue over the cause of the economic downturn.

Some attribute the recession to the drop in the oil prices in the global market, while some believe the activity of the militants and pipeline vandals in the Niger Delta region of the country which caused significant reduction in the volume of crude oil production was responsible for the recession.

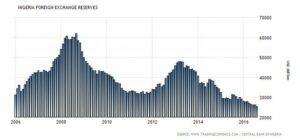

The current economic situation in Nigeria was primarily caused by insufficient foreign exchange (forex) in the Central Bank of Nigeria (CBN) to fund imports. This with its enormous effects on the economy caused the recession.

Prior to the drop in the global crude oil prices in 2015, Nigeria’s economy relied heavily on crude oil earnings, with steady inflows of Foreign Portfolio Investment (FPI), and Foreign Direct Investment (FDI). In a report by NBS, Nigeria received 95 per cent of its export earnings and 70 per cent of government revenue from the oil sector.

Source: Bloomberg Terminal

According a tweet posted by @CNNMoney, Nigeria was estimated as the 3rd world fastest-growing economy in 2015 with an estimate of 7 per cent growth, behind only Qatar (7.1 per cent) and China (7.3 per cent).

What now led to the recession? When the global crude oil prices dropped, the forex reserves also dropped due to over reliance on the sector, but the nation failed to devalue its currency which led to the shortage of forex earnings to fund imports. This, however, made investors struggle to get forex for their imports.

Given that the nation could not explore other investment opportunities for the production sustainability of the economy, the FPI and FDI investors got frustrated over the shortage of foreign exchange to pay for raw materials and machines, so they eventually left the market. When that happened, the value of production, which is the major function of GDP, began to fall.

The investors who decided to stay had to pay significantly more for these imports because of the high cost of production materials.

No doubt, the ripple effects of this which include, 2-digit inflation rate – cost-push inflation – which has developed immunity against the central bank’s monetary policy rates and soaring unemployment rate is evident in Nigeria’s economy today.

Since then, the economy has witnessed a hiccup in its production capacity, thereby causing a steady drop in GDP. The economy recorded negative growth in the first quarter of 2016, which led the economy into recession for the first time since a full-year recession in 1987.

Apparently, the reason for the recession was not of the fall in oil prices or poor saving culture as many perceived, but by the lack of sound economic policy to create alternative foreign exchange earnings such as the non-oil exports.

These problems can be solved with policies that make the market attractive to foreign investors. These policies could include: reducing port charges and other hidden import duties, boosting foreign exchange reserves, and promoting both local and foreign investments in the country. Once these actions are taken to provide a good economic environment, long-departed economic growth will come back again.

Reach me on Twitter: @SegunAndrews.

photo credit: kenteegardin via photopin (license)

…………………………………………………………………………………………………………………

About me: I am a citizen journalist trained by the International Centre for Journalists (ICFJ) to report vital health, environment and poverty related issues in the Niger Delta region of Nigeria.

I stepped up in my journalism career with training by the Bloomberg Media Initiative Africa (BMIA) to become a financial, economic and business journalist.

I report economic data, trading sessions from Nigeria Stocks Market and other key financial institutions.

I am a passionate young man who has determined to keep telling the stories behind public data.

…………………………………………………………………………………………………………………

Opinions expressed in this article are those of the author and do not necessarily represent the views of the Commonwealth Youth Programme. Articles are published in a spirit of dialogue, respect and understanding. If you disagree, why not submit a response?

To learn more about becoming a Commonwealth Correspondent please visit: http://www.yourcommonwealth.org/submit-articles/

…………………………………………………………………………………………………………………